The New Normal

From crisis management to a new vision of future scenarios. According to the new McKinsey report, The State of Fashion, changes in the global economy and, above all, in consumer behavior, need to be taken into account.

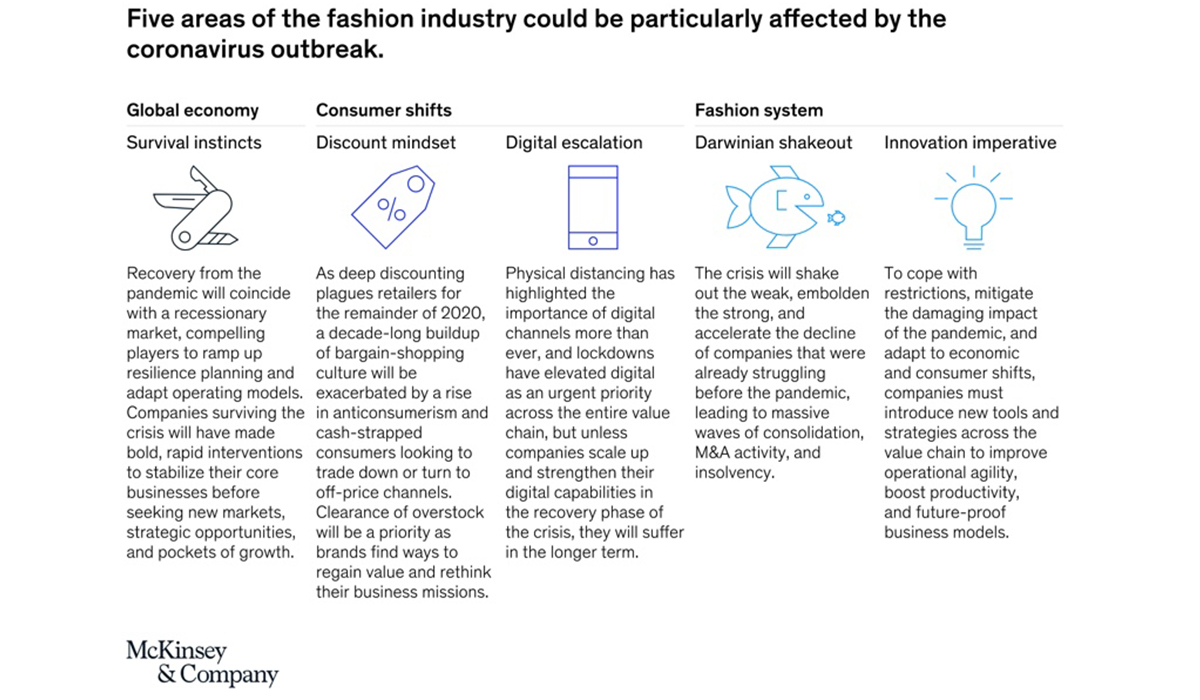

What will tomorrow’s new normal be after this exceptional event? In a preview of The State of Fashion report that McKinsey and Company recently published, in collaboration with BOF, the starting point is already a significant figure that deals an unwelcome blow on the entire fashion and luxury system: between January and the end of March 2020, capitalization in this market dropped by an average of almost 40%. For an industry that is able to generate annual global revenues of $2.5 trillion – prior to Covid-19 – it is a staggering amount. Going into details, for personal luxury goods (fashion, accessories, watches, jewelry), a global reduction in annual revenues of between 35 and 39% has been estimated as well as a positive growth of 1 to 4% in 2021 (compared to 2019). The consumption standstill is further aggravating the offer side of the crisis. The forced closure of the stores, for a sector that still depends greatly on off-line channels, together with the final consumer’s instinct to prioritize essential goods, inevitably has an effect on brand profits and depletes liquidity reserves. On-line channels, which have decreased by 15 to 25% in China, 5 to 20% in Europe and 30 to 40% in the United States, are not doing much better. In its new analysis, McKinsey identifies three environments and five analysis points that could suffer the consequences of this pandemic more greatly. Here is a short summary:

Global economy

Survival instinct. Recovery will coincide with a period of recession. Companies that survive will intervene rapidly to stabilize their core business, before appearing on new markets, evaluate new strategies and growth opportunities.

Buying behavior

Attraction to products at reduced prices. Faced with the fact that they will have to find new ways to re-acquire value and re-think their business mission, one of the big brands’ priorities will be freeing up stock.

Growth of digital platforms. Physical distance will make digital channels increasingly important. If companies do not intervene to strengthen and encourage the use of digital tools, they will feel the impact in the long term.

Fashion system

Darwinian selection. The crisis will give the strongest companies even greater strength and speed up the decline of those that were already weak prior to Covid-19. We will see a wave of mergers and takeovers.

Innovation. To mitigate the damage caused by the crisis, adapt to new economic scenarios and consumer behavior, companies will have to invest in new tools and adopt new strategies to reinforce their supply chains, improve operability and productivity as well as re-think their business model.

The complete "The State of Fashion" study by McKinsey and Company can be found on: https://www.mckinsey.com/industries/retail/our-insights/its-time-to-rewire-the-fashion-system-state-of-fashion-coronavirus-update