Luxury: The Future is Phygital

Yesterday saw the eleventh edition of Consensus Altagamma in collaboration with Bain & Co. An overall forecast of personal luxury goods consumption for 2020 and growth estimates until 2025.

Stefania Lazzaroni, General Manager of Altagamma commented: «Consensus Altagamma, with estimates from 22 analysts, foresees a considerable drop in global consumption and a 30% fall in sector company profitability in 2020. A strong positive sign is the performance on retail and wholesale digital channels that show +16% and +12% respectively. Companies’ digital transformation will certainly be strengthened and the crisis will lead to new lifestyles – more sustainable, moderate and aware – whose interpretation will be decisive in re-launching high-range». The personal luxury goods industry will have to tackle disturbing changes and forces in the coming years and it is mainly in the hands of the players within the sector as to how to re-shape it, starting from now. While they react in order to manage the current crisis, brands must decide and plan now how they intend to guide the industry’s transformation, starting from the consumer.

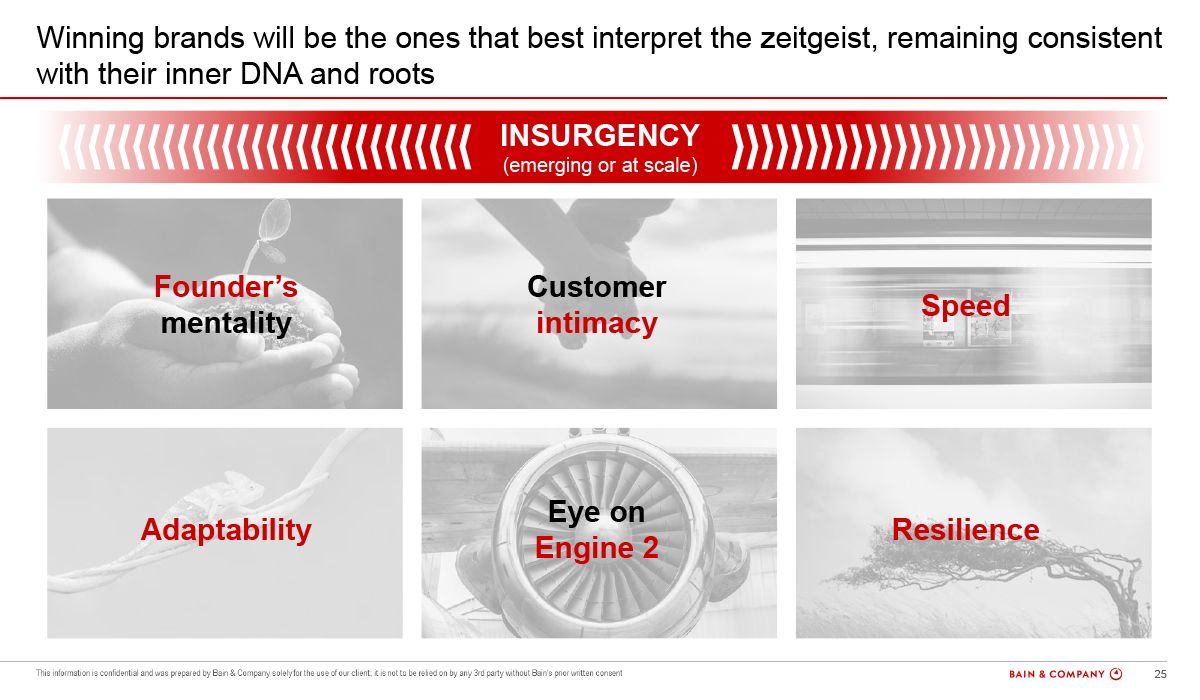

«We expect the luxury market to recover but the sector will be profoundly transformed», said Claudia D’Arpizio, Partner at Bain & Company and author of the study. «The current crisis is forcing this industry to think even more creatively and to innovate even more quickly to meet consumer demand and overcome the restrictions on the channels. The brands that will come out on top will be those that manage to better interpret the zeitgeist while still remaining in line with their own heritage and roots». Further comments came from Federica Levato, Partner at Bain & Company and co-author of the study: «Consumers see a world that has changed deeply, one which luxury brands must necessarily adapt to. Safety in stores will be obligatory and always associated to the magic of the luxury experience: creative ways to attract customers into the store or to take them directly to the products, will make the difference. The speed at which this market grows will depend on brands’ strategic responses to the current crisis and their ability to transform the luxury industry to the benefit of the consumers». Let’s look at the estimates for 2020. For those markets most exposed to the crisis, and with the absence of international tourist flows, especially Chinese tourists, an average drop of 20% is foreseen, distributed as follows: Europe (-29%) and the Americas (-22% for North America and -21%for Latin America). Chinese consumer purchases (-9%, the first to emerge from the crisis), Japanese (-14%) and the rest of Asia (-16.5%) are the expected downturn figures in 2020, even if the impact will be less compared to European (-25%) and North American (-21%) consumer purchases.

As regard products, the worst impacts are foreseen for jewelry (-23%), watches (-25%) and clothing (-21.5%), while leather goods (-17%) and cosmetics (-13%) will see a lower fall. Jewelry purchases have particularly been affected by the price of gold which has reached extremely high levels in recent months and, even if some jewelry brands are turning out to be safe havens in China with significant growths, these categories are generally suffering more than all the others. This type of product has not benefitted from on-line sales because, traditionally, they have always been bought in stores through a buying ritual that consumers prefer. Moreover, they are products that are highly affected by the lack of tourists and are also gift items that are considered as less vital. What will the coming Consumer Trends be? There are two scenarios, Now and Here to Stay:

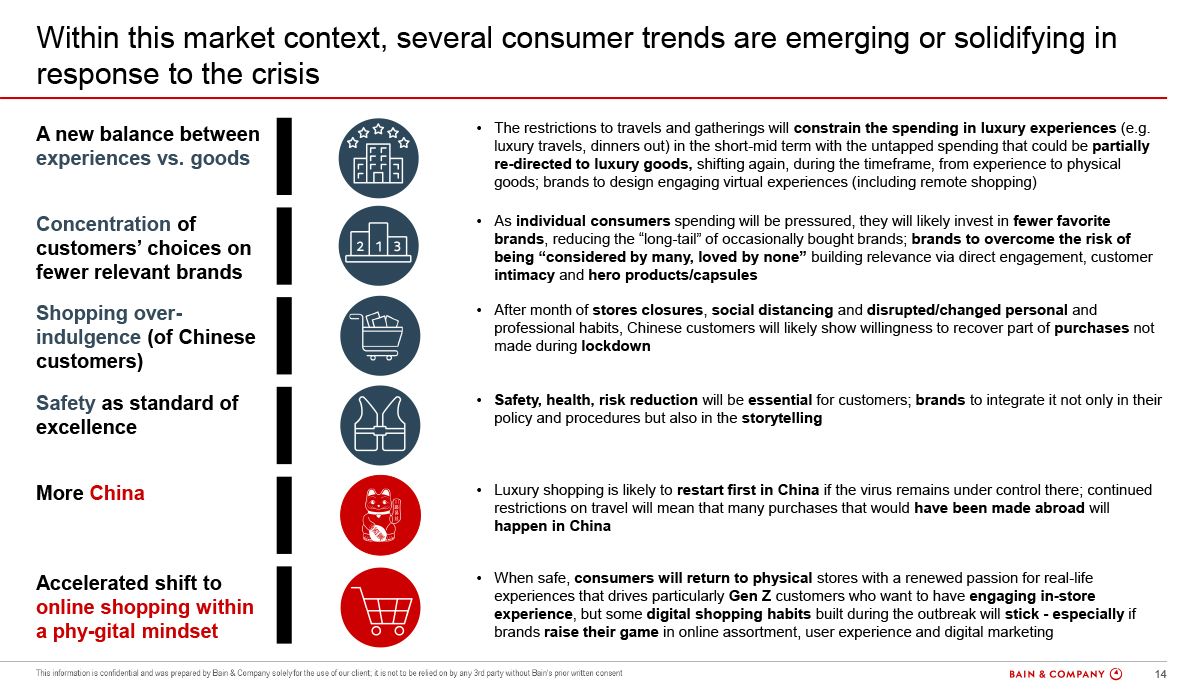

NOW:

1) New balance between experiences and products. Experience has been particularly strongly hit

because nobody is traveling, people are afraid to travel and this will affect everyone’s

spending.

2) Focus on brands that are more reassuring, large brands or those that have kept customer

relations alive without wanting to sell at all costs. There will be winners and losers.

3) Revenge shopping. There will be a shopping flare-up when stores open or when normality

appears to return. It will then stabilize at a lower rate of consumption than before the crisis.

4) Safety: first-rate standards in the buying process (packaging/wait will become secondary)

HERE TO STAY:

1) More China

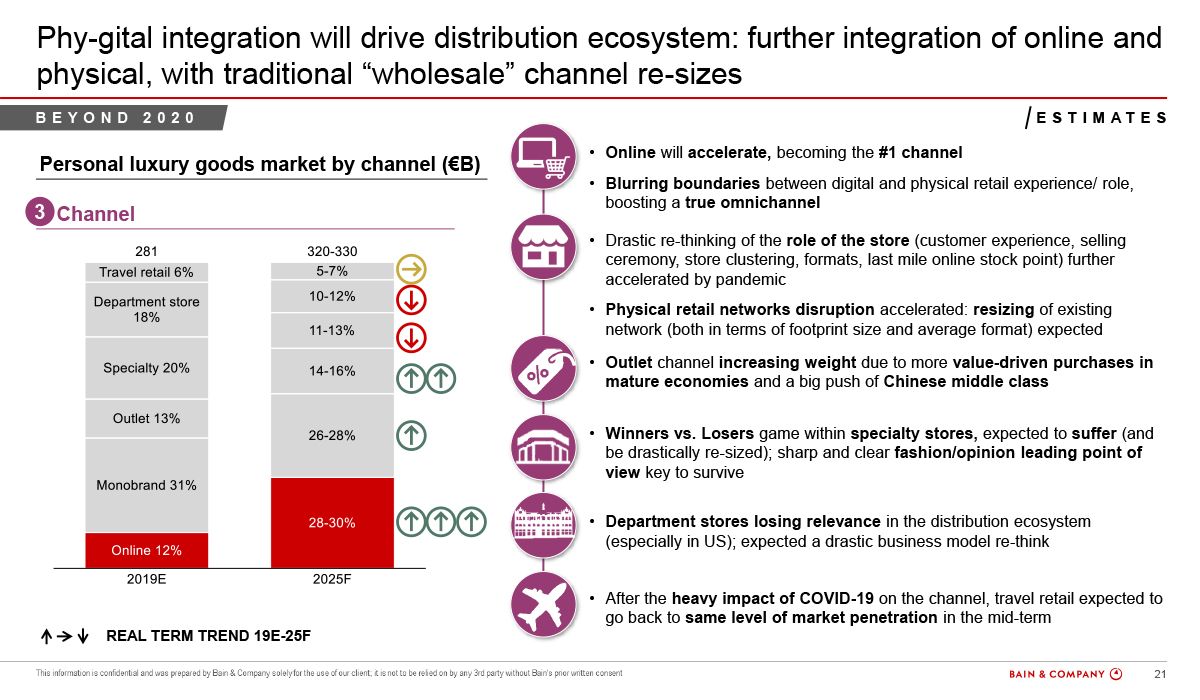

2) On-line channel legitimized for older people too. The psychological barriers will fall but there

will be a happy return to physical in a Phygital balance. An extremely strong balance between

on-line usage and the physical place which will still be a experiential moment in which to

communicate with the brands. Omni-channeling will be fundamental as will knowing how to

work on all these touch points.

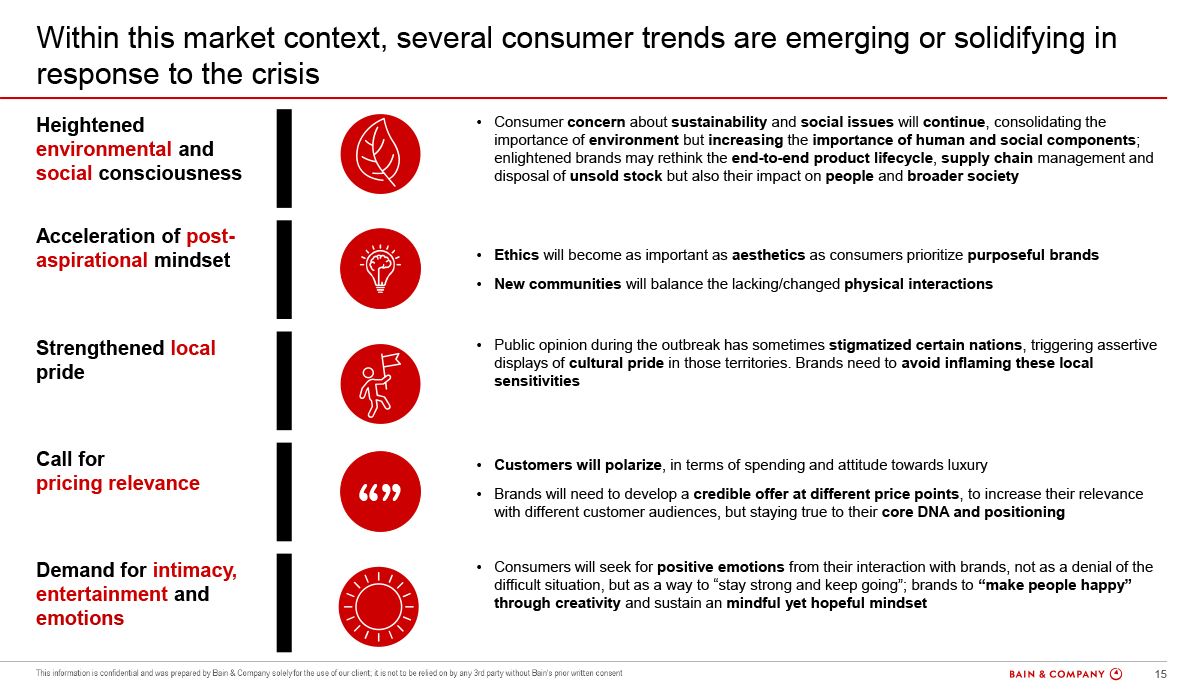

3) Faster sustainability awareness.

4) Local pride. Brands that speak of culture will be stronger and local brands will grow.

5) Pricing relevance. On entering into a not-so-short recessive moment, attracting consumers at

all price ranges with creative content will be important.

6) More intimate communication, focusing on emotions, also by seeing the product as a content

creator.

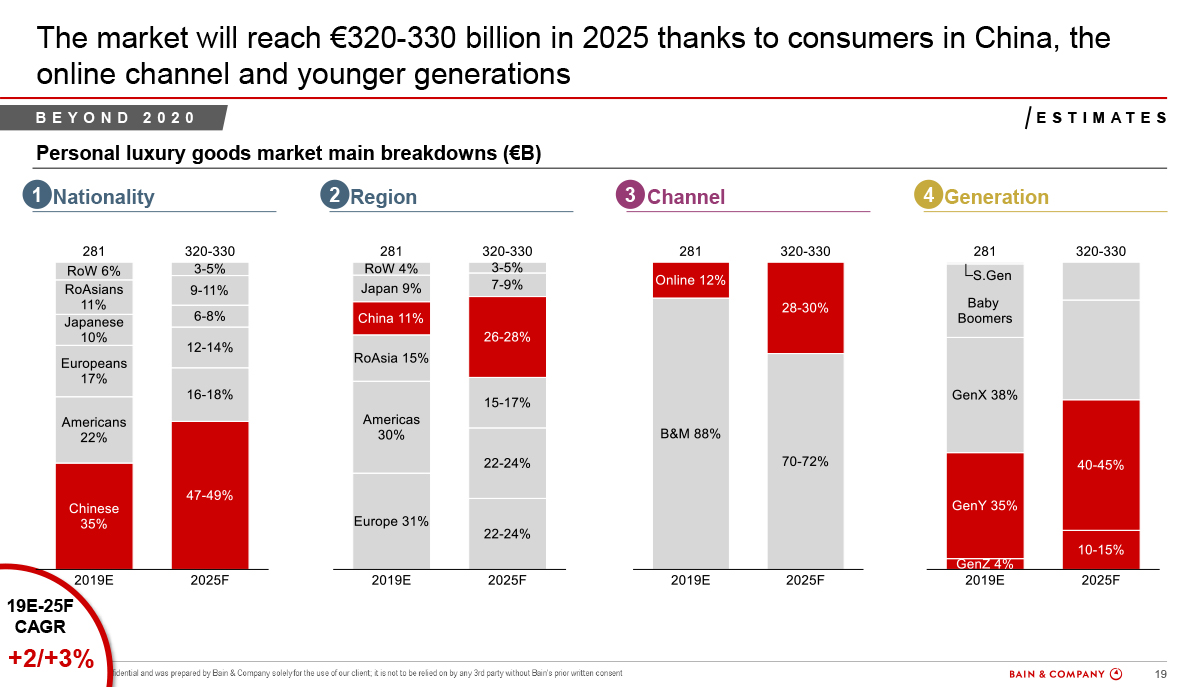

A return to the levels (in absolute value) of 2019 is foreseen in 2022 or 2023, with different growth trajectories over the coming years. Trajectories that will depend on how the main market drivers develop, including (and above all) how brands strategically respond to the crisis. It is expected that, by 2025, the market will reach €320-330 billion, which would represent a 2019-2025 growth rate of +2/+3% (CAGR). D'Arpizio concluded: «This analysis includes forecasts on this year’s trend and recovery after 2020 based on the information we have today and we have avoided making it into a health report. Therefore, there are no forecasts for a further lockdown, nor of an emergence from the health crisis earlier than the times given by the experts. (ref. no vaccine within the end of the year). From today, after 2020, we will see a new concept of New Normal. The market will decrease, more than ever before, and we expect a V-shaped recovery which will, however, not go at the same speed as the 2009 crisis. The crisis will act as an accelerator for some trends and China will become the top luxury market in terms of consumption with the rich Chinese buying more than 50% of their purchases in China. A strong Chinese consumption, then.

It will be essential to establish a Road to Customer, reviewing service strategies and reasoning in view of a distributional eco-system, the buzz word of the moment and an incredible accelerator. Everything lies greatly in the hands of the brands and how they will define a way out of the crisis. An internal revolution is required that focuses on customer intimacy, which means engaging the customer in real and intimate relations which will allow him/her to be resilient in coming crises. Companies need to act quickly in order to remain at the helm with a solid grip and a clear objective. The founder’s initial purpose, the deep why, needs to be re-discovered and explained to the customer. And I will conclude by borrowing a quotation from Darwin: 'Only those who adapt to changes do not die'».