Tools for Retailers

Buy now, pay later, virtual money is making its way into the retail world, overcoming borders, nationalities and creativity

It is a given fact that virtuality has invaded our lives, as well as our wallets, since the majority of purchases are no longer made with paper but with plastic, even when we are buying in person. Money travels to the sound of “beeps” and hard cash is going the same way as old practices, such as paying by instalment. That’s right, even the use of instalments, of “buy now, pay later”, is racing ahead in virtual money, with apps that have become the “unicorn” of the international market in the blink of an eye. And that's not all. Going beyond what was unthinkable a few years ago, someone initially created an App and then a Chrome extension to earn cryptocurrencies in cashback. And so on and so forth, sailing into a world that now has no national boundaries, let alone limits of imagination.

1. SCALAPAY

2. TENDER

3. CEGID

4. STORMX

SCALAPLAY

WHO: SIMONE MANCINI, JOHNNY MITRESVKI, RAFFAELE TERRONE, DANIELE TESSARI E MIRCO MATTEVI, FOUNDERS

WHY: ITALY'S LEADING PAYMENT METHOD FOR THE BUY NOW, PAY LATER SEGMENT

WHERE: MILAN, ITALY

WEB: SCALAPAY.COM

Scalapay was the first Italian FinTech to launch the “Buy now, pay later” payment formula. Founded in 2019 by Simone Mancini and Johnny Mitresvki, who were joined in the early stages by Raffaele Terrone, Daniele Tessari and Mirco Mattevi, Scalapay is among the most popular payment methods in Southern Europe and the top payment solution in the Trustpilot rankings in terms of customer satisfaction. Available at over four thousand physical stores and in the e-stores of more than three thousand brands in the leisure shopping segment (luxury, men/women/children's clothing, accessories, sports, cosmetics, electronics, entertainment and travel), in the space of two years, Scalapay has become the Italian market leader for deferred, three-instalment payment systems. The Italian company has also taken its payment system to France, Germany, Spain, Portugal, Finland, Belgium, Holland and Austria with the aim of covering the whole of Europe by the end of the year. Thanks to its simple formula, which allows purchases to be made in three instalments with no interest or commissions for the end user, Scalapay is a partner for companies such as Moschino, Alberta Ferretti, MSGM, Luisa Spagnoli, Decathlon, Intimissimi, Calzedonia and VeraLab, which have seen an average 48% increase in the value of their average receipt, an increase in basket conversion and a decrease in abandonment rate. In two years, Scalapay has raised $203 million in funding from partners and institutional investors such as Tiger Global, Baleen Capital, Woodson Capital, Fasanara Capital and Ithaca Investments. The latest funding round, dated September 2021, raised $155 million in equity funding as part of the Series A investment round.

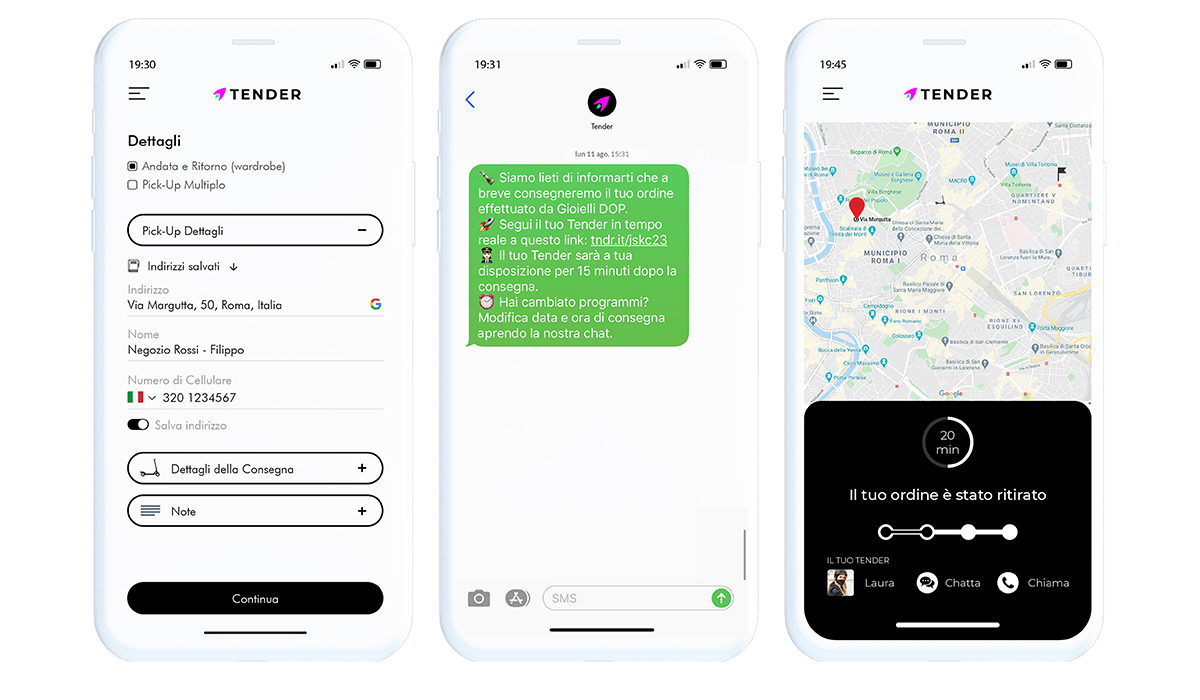

TENDER

WHO: FILIPPO MARIA CAPITANIO E GIORGIO ISABELLA, FOUNDERS. WHY: THE FIRST LUXURY DELIVERY FOR JEWELRY, FASHION AND BEAUTY

WHERE: ROME, ITALY

WEB: TNDR.IT

«Statistically, 50% of e-commerce users, even the most hardened, abandon the 'shopping cart' and do not confirm a purchase due to lengthy delivery times, which on average is around three working days. So, we set out to find alternative formulas, and began to imagine how the in-store and online shopping experience might evolve, starting with home delivery,» says Filippo Maria Capitanio. «Tender is built on three pillars. First of all, a premium service, which consists of guaranteeing home deliveries 7 days a week, from 10 a.m. to 10 p.m., by appointment, within an hour of purchase confirmation, either on the same day or whenever is suitable for you. And that's not all. Deliveries are made by our Personal Style Riders, highly qualified staff who bring the Brand Experience right to your doorstep. Our riders have specific training, an interest in the sector, know the product they are delivering, speak one or more foreign languages and are true "bearers" of a certain brand's values. Through the app and the link sent as the delivery gets underway, the end customer knows exactly who will be knocking at his door. He will immediately receive the rider’s photo and phone number so that he can contact him and follow the live tracking on the map. The third and final pillar is sustainability: all our vehicles are zero-emission. We have an intermodal approach, using our own fleet of electric vehicles but also taking advantage of public transport and all existing sharing services. We offer a BtoB, store to store, warehouse or store to end customer service and, for returns, an end customer to point of departure service. Tender is not a BtoC app. That needs to be specified, although an extra area that we are developing very well is for and with celebrities. These people tend to move a large volume of goods and usually it is the store manager who takes care of the delivery directly to their homes or to the set. Thanks to Tender, now every brand can deliver clothes and jewelry safely. We are currently operative in Rome, Milan, and in the next months in Florence and Cagliari.»

CEGID

WHO: MARIO DAVALLI, COUNTRY MANAGER SUD EUROPA

WHY: OMNICHANNEL AND COLLABORATIVE SAS SOLUTION FOR STORES

WHERE: LYON, FRANCE

WEB: CEGID.COM

Digital transformation is setting a new pace for retailers. In the last two years, the sales staff have had to deal with an everincreasing number of services, from the collection of goods in the store to the need to integrate web catalogues, but not only: even critical issues, just think of the opening calendar and health protocols. And right the sales staff have now taken on a new role, which is more flexible and strategic towards the end customer. «The future of stores now depends more than ever on the acceleration and adaptation capabilities of retailers to offer consumers compelling experiences along with innovative and useful services, while simplifying management for staff and optimizing IT costs,» explains Mario Davalli, Cegid Country Manager for Southern Europe, «Cegid Retail Live Store will allow brands and retailers to capitalize on their physical store network to offer an amazing unified shopping experience, attracting new sales opportunities; this is “Retail the New Way” ». More precisely, Cegid Retail Live Store brings together in a single terminal all the information necessary to support the customer, both in the sales and consultancy phases, between online and physical store. In this way, sales assistants can respond more efficiently and smoothly to customer requests.

STORMX

WHO: SIMON YU, CEO AND CO-FOUNDER, CALVIN HSIEH, CTO AND CO-FOUNDER

WHY: APP AND CHROME EXTENSION TO EARN CRYPTOCURRENCIES IN CASHBACK

WHERE: MIAMI, USA

WEB: STORMX.IO

According to the Coinmarketcap.com observatory, the most authoritative website specifically for decentralized finance, there are now 6,749 cryptocurrencies with a total capitalization of $1,865 billion. Started in 2009 with the birth of Bitcoin, the cryptocurrency ecosystem is the subject of constant reflection on the part of the financial establishment, while the general public is appreciating the opportunity. Nevertheless, making money with cryptocurrencies requires more than basic skills. Simon Yu and Calvin Hsieh, co-founders of StormX, an app and Chrome extension for obtaining cryptocurrencies in cashback while shopping online, have made it more fluid. The StormX mechanism is quite simple: just download the app or extension and activate the promotion every time you shop in the more than one thousand affiliated stores to receive a percentage of return on what you buy. On a technological level, StormX combines the potential of blockchain with the benefits of traditional cashback, making it an easy and democratic system since no high finance skills are required to access it. Retailers that have opened up to StormX include big names such as Microsoft, Lenovo, Nike, Levi's, Ebay and Uber as well as Groupon, Macy's, Sonos, Lego, New Balance and Adidas. And that’s not all. StormX has also implemented a membership system and a credit card through which cryptocurrencies can be effortlessly converted into cash. Six digital currencies are currently available: Bitcoin (BTC), Ethereum (ETH), StormX (STMX), Litecoin (LTC), Dai (DAI) and yearn.finance (YFI).